SLS/Alternative InvestmentsAtlantic Financial-US has strategically partnered with Atlantic Financial Asia Ltd to offer alternative investments to investors in Asia with services of life settlement portfolios and financial assets such as financial derivatives, private equity, and hedge funds. These instruments allow our investors to create and customize longevity products with low risk. Our Partner-Atlantic Financial Asia Atlantic Financial (ASIA) was formed to take advantage of the investment opportunities that exist today as a result of the global financial crisis. Through our partner, Atlantic Financial in the United States we have access to Senior Life Settlements (SLS) and other alternative investments. Atlantic Financial (ASIA) provides independent advice to investors and fund managers in Asia on alternative asset class and distressed assets in the USA. Our clients are pension funds, trust funds, hedge funds, large company and high net worth individuals. We currently specialize in US originated Senior Life Settlements and US based distressed commercial real estate notes. Senior Life Settlements

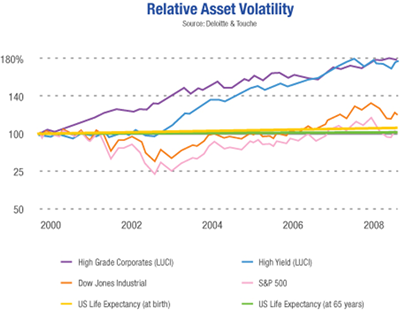

Uncorrelated Asset Class

*Report for the Association of British Insurers on Key Correlation Assumptions in ICA for Life Office, Deloitte and Touche LLP, May 2005. To learn more about our counterpart Atlantic Financial Asia Ltd please click on the link www.ATFinancialAsia.com

|

Atlantic Financial :: 860-841-1361 :: info@atlanticfinancialmarketing.com

171 Market Square , Suite 106 , Newington, CT 06111

Privacy Policy